Renters Insurance in and around Mount Pleasant

Looking for renters insurance in Mount Pleasant?

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Home is home even if you are leasing it. And whether it's an apartment or a townhome, protection for your personal belongings is beneficial, even if your landlord doesn’t require it.

Looking for renters insurance in Mount Pleasant?

Rent wisely with insurance from State Farm

Why Renters In Mount Pleasant Choose State Farm

It's likely that your landlord's insurance only covers the structure of the home or townhome you're renting. So, if you want to protect your valuables - such as a stereo, a cooking set or a TV - renters insurance is what you're looking for. State Farm agent Melissa Schafer can help you examine your needs and keep your things safe.

Don’t let the unknown about protecting your personal belongings make you unsettled! Contact State Farm Agent Melissa Schafer today, and see the advantages of State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Melissa at (262) 554-8833 or visit our FAQ page.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

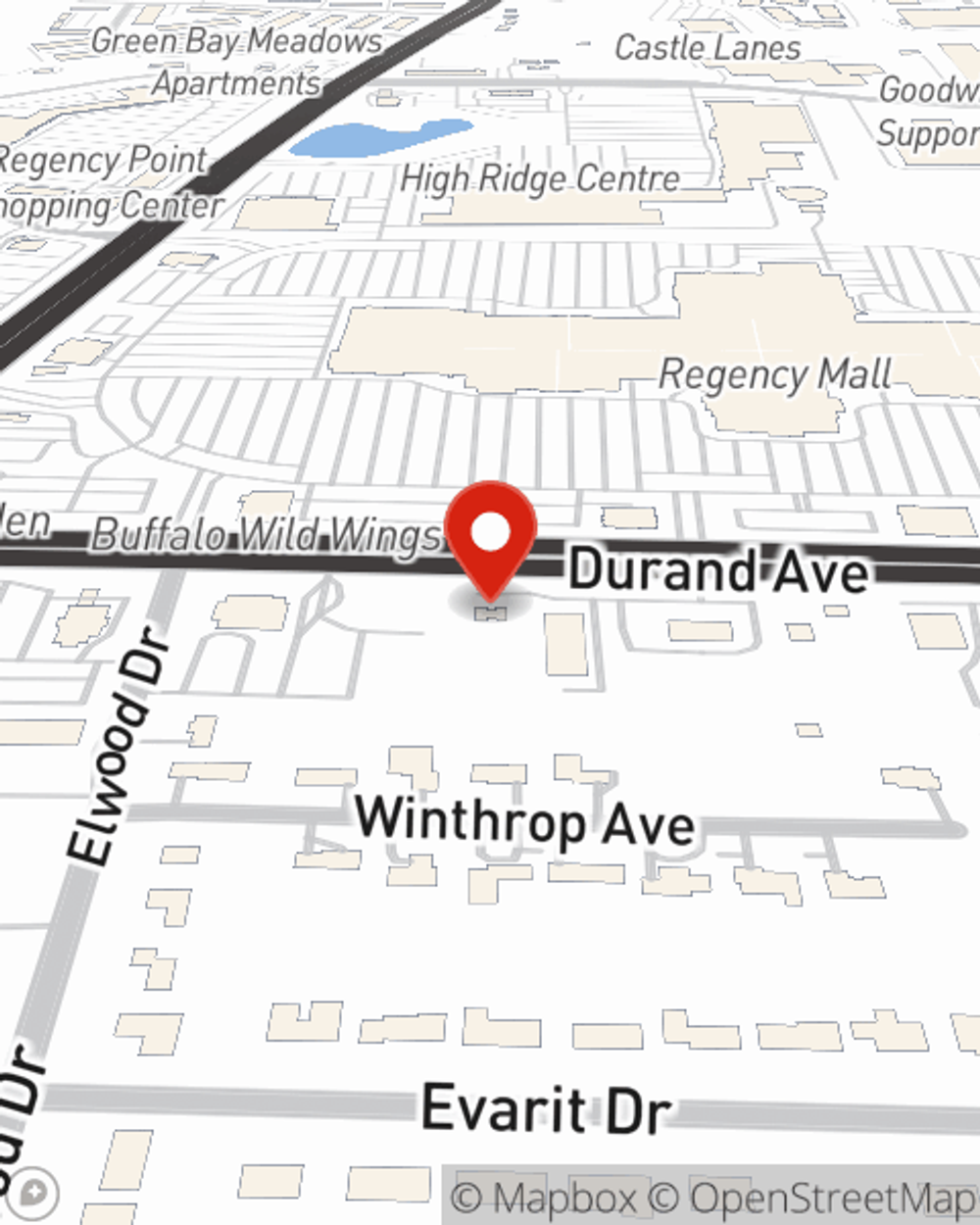

Melissa Schafer

State Farm® Insurance AgentSimple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.