Auto Insurance in and around Mount Pleasant

Discover your car insurance options from State Farm

Take a drive, safely

Would you like to create a personalized auto quote?

Be Ready For The Road Ahead

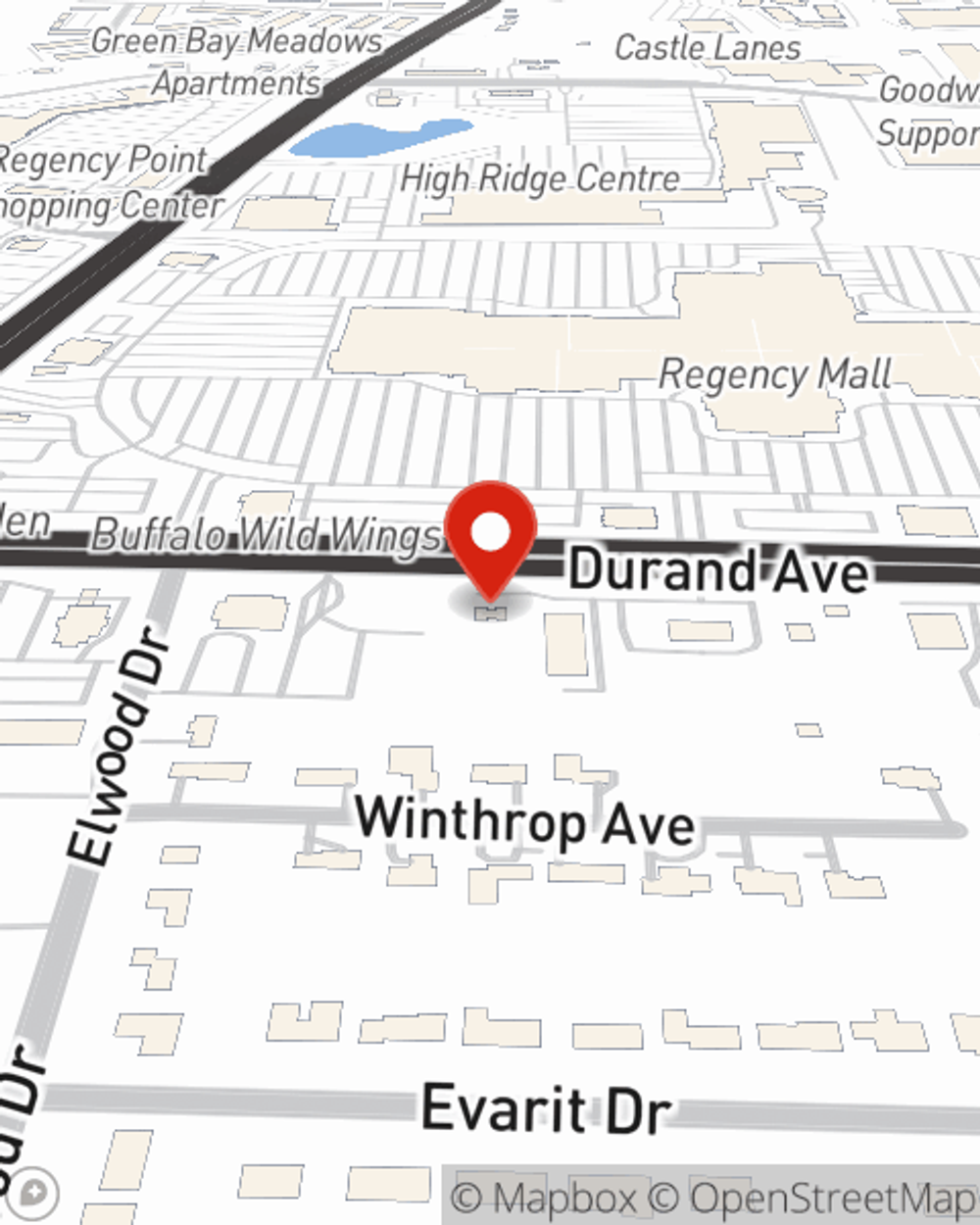

You want an agent who is not only knowledgable in the field, but who is also prompt and attentive. That's State Farm Agent Melissa Schafer! Mount Pleasant drivers choose Melissa Schafer for a protection plan aligned with their unique needs, from a top provider of auto insurance.

Discover your car insurance options from State Farm

Take a drive, safely

Your Quest For Auto Insurance Is Over

Whether you're looking for dependable protection for your vehicle like uninsured motor vehicle coverage, car rental and travel expenses coverage and comprehensive coverage, or wonderful savings options like Drive Safe & Save™ and a newer vehicle safety features discount, State Farm can help. State Farm agent Melissa Schafer can help you choose which individual options are right for you.

Don’t let mishaps slow you down! Call or email State Farm Agent Melissa Schafer today and find out how you can save with State Farm auto insurance.

Have More Questions About Auto Insurance?

Call Melissa at (262) 554-8833 or visit our FAQ page.

Simple Insights®

Is Medical Payments Coverage worth it?

Is Medical Payments Coverage worth it?

Wondering if Medical Payments Coverage is worth it? Learn about its affordability, no deductibles and how it fills the health insurance gaps to help you decide.

Understanding your car rental reimbursement coverage: what to know

Understanding your car rental reimbursement coverage: what to know

Understand your auto policy and how rental reimbursement coverage could be a beneficial addition to your insurance plan.

Melissa Schafer

State Farm® Insurance AgentSimple Insights®

Is Medical Payments Coverage worth it?

Is Medical Payments Coverage worth it?

Wondering if Medical Payments Coverage is worth it? Learn about its affordability, no deductibles and how it fills the health insurance gaps to help you decide.

Understanding your car rental reimbursement coverage: what to know

Understanding your car rental reimbursement coverage: what to know

Understand your auto policy and how rental reimbursement coverage could be a beneficial addition to your insurance plan.